The most useful financial application for your life!

Hello, I'm Elva, and I aspire to design better everyday experiences for people. My biggest interest is in the varied lives that people lead, and it inspires and shapes my design practice. To understand this in more depth, I have always tried to find opportunities to experience new environments, cultures, and societies. This effort led me to study abroad in New Zealand after graduating from university in South Korea. Since I moved to New Zealand, I have been working and freelancing for 4 years to gain work experience as a designer. I am currently working as a junior UI/UX designer to learn about dealing with user experience and interface in the industry in a professional manner. My dream is to become a designer who can influence the world to make people take one more step toward happiness, using lived experiences and technology.

This project aims to support financial independence and management skills in the target audience of young adults aged 20-30, who wish to learn to manage and improve their finances more effectively through the use of savings and stock trading. This year, due to COVID-19, many people have been struggling with their finances. In particular, young people with low levels of wealth and confidence with money have needed to change the way they view and manage their personal finances - 84% of New Zealanders have increased investments and savings compared to previous years. Online share trading has become a particularly popular way for those who wish to take advantage of the dipping market. (Cook, 2020)

This project began by reflecting on the above social phenomenon. From the user interview, I found that most young people rely on bank statements for tracking money, and felt that planning their finances and keeping an account book were bothersome chores. Under the current circumstances, their attention has turned towards investment as a way to improve their financial situation. However, without understanding your personal finances, investment has a high entry-level barrier.

During the research period, an idea came across my mind that would become one of the key ideas for this project. In my workplace, I had the task of setting up a Xero accounting service for a company. I saw potential in the key function of this service, which featured integration with banks to get data for accounting. According to the United Kingdoms' Office of National Statistics, half of adults and more than three-quarters of 25-34 year olds now manage their money online. (Rolfe, 2015) Also, investment platforms which target young adults, such as Sharesies or Hatch, have grown immensely. Integration with online apps related to the user's transactions would remove the need to input data individually. In other words, the app could make accurate and advantageous conclusions while minimising the unnecessary inputs that make it a chore for many young adults.

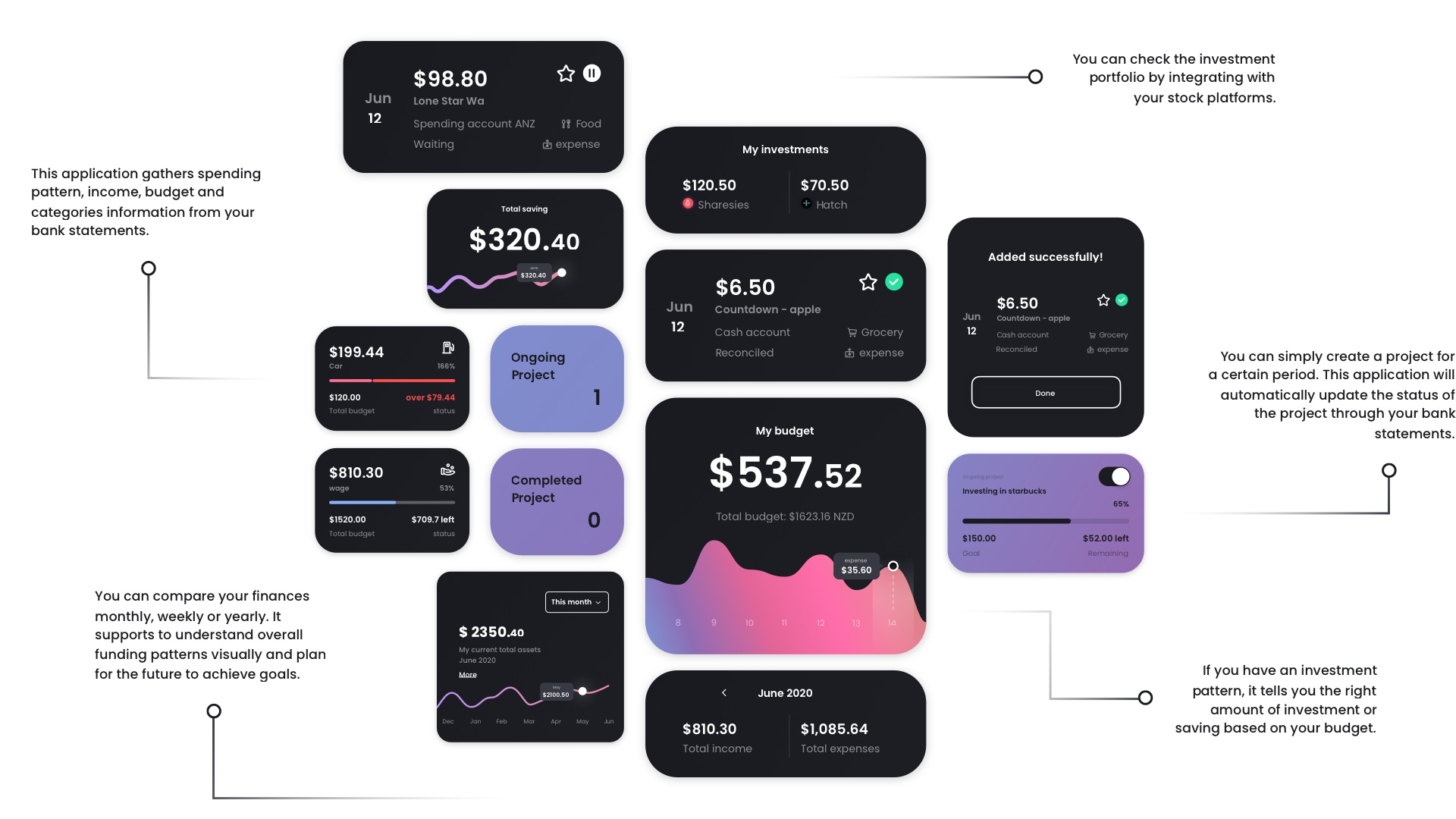

Once the app receives the data that it requires, it automatically calculates the user's daily, fortnightly, monthly, and yearly budget based on their spending patterns. It then recommends realistic steps to take to improve or stabilise the user's finances. It also has a feature that will remind users to pay bills or taxes, preventing overdue fees, and to create a personal project that provides a visual indicator to see where the user is at with their goals. Therefore, the platform would allow the user to holistically manage their finances throughout all areas of their life, including investments and savings - making it a useful service to support financial management for young adults.

There is no need to track your finances by writing on a cashbook or importing data manually into your application, then agonising over what it means. Simply integrate with your bank, and manage everything in one application. Also, based on your spending patterns, it automatically comes up with solutions for saving and investing for your life goals. Just like your own financial assistant!

Cook, F. (2020). Young adults are saving and investing more – here's how to do it well. Nzherald.

Rolfe, A. (2015, March 12). Youth attitudes to banking and online banking services - Payments Cards & Mobile. Retrieved May 15, 2020, from Payments Cards & Mobile website: https://www.paymentscardsandmobile.com/youth-attitudes-to-banking-and-online-banking-services/ segue into your project description