A Money Management Mobile Application

Nest is a money-management mobile application that aims to motivate and encourage young people to improve their relationship with their money. The goal is to create good financial habits that will help them to achieve their financial goals and ultimately promote financial wellbeing. This project has a human-centered design approach to understand financial wellbeing. Throughout the project, experts and prominent voices in the personal finance industry were interviewed to provide real-world constraints and the target audience was surveyed to better understand their relationship with their money.

Nest is a money-management mobile application that aims to empower young people to be in control of their money. The idea behind this project evolved from my interests in personal finance and behavioural psychology, and the global economic downturn due to COVID 19. The nation-wide lockdown in New Zealand due to COVID 19, opened up the discussion about how we manage money, especially in times of economic volatility, and how people who have lost their jobs, can reinvent themselves to become economically active again.

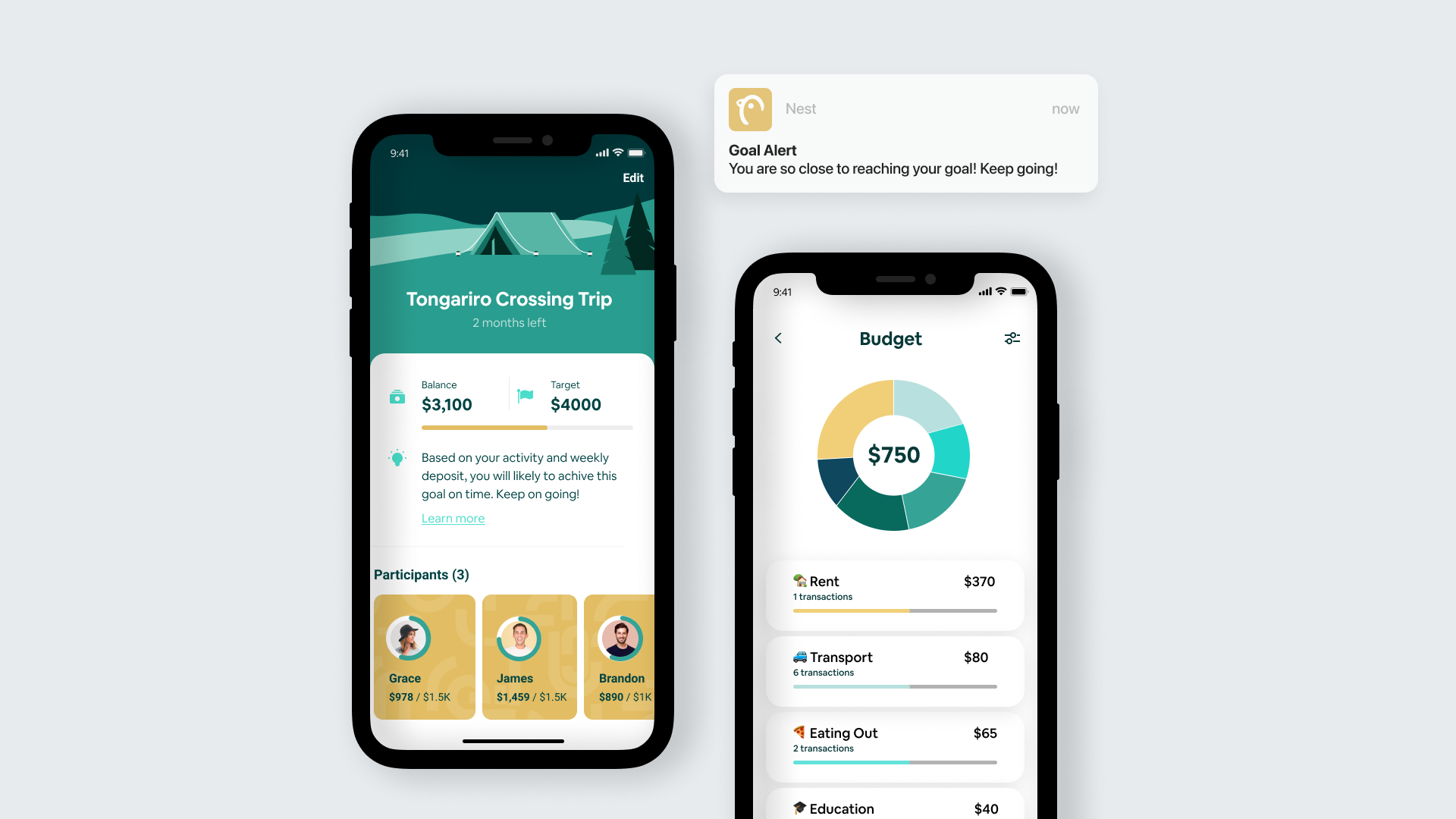

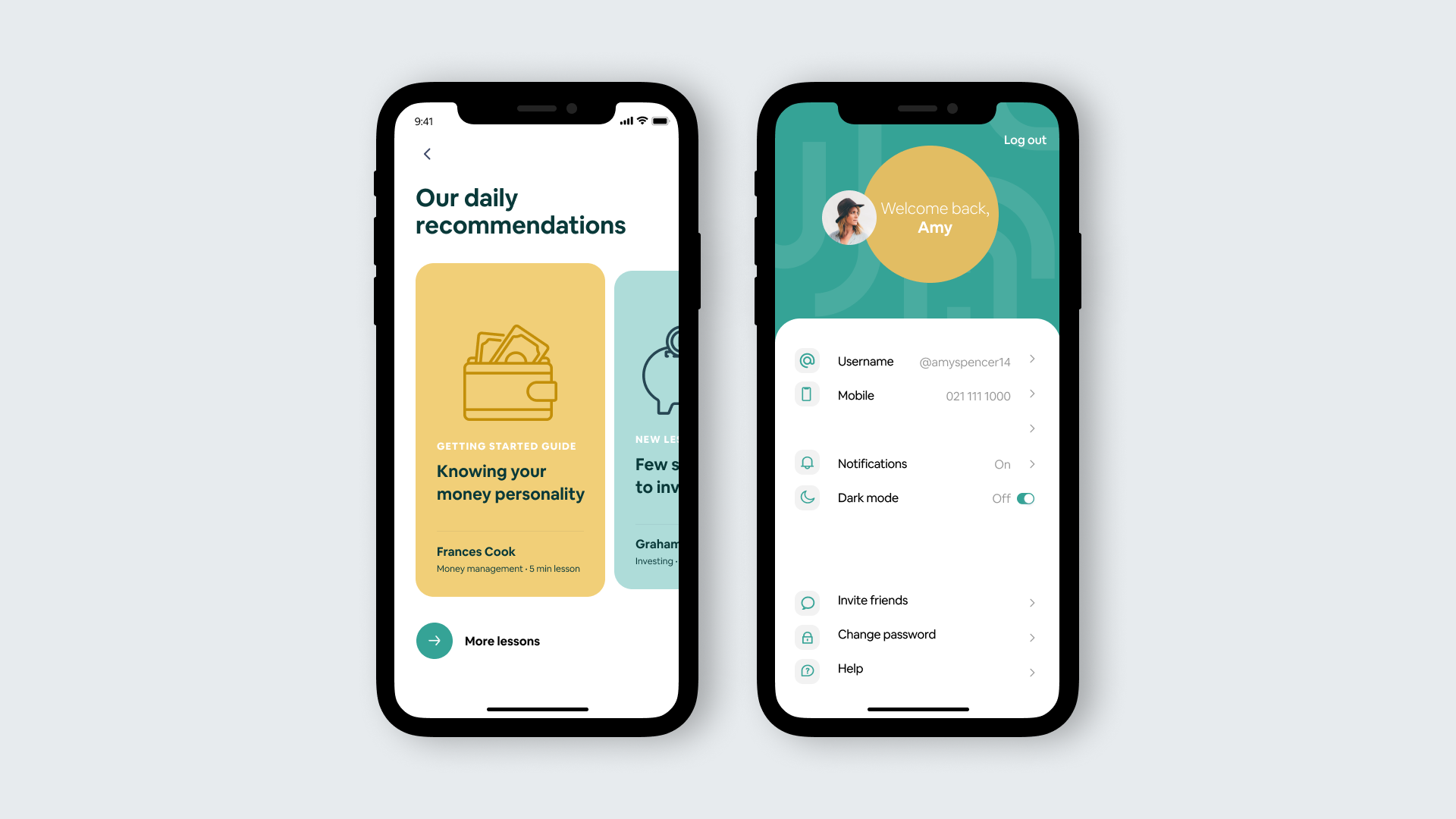

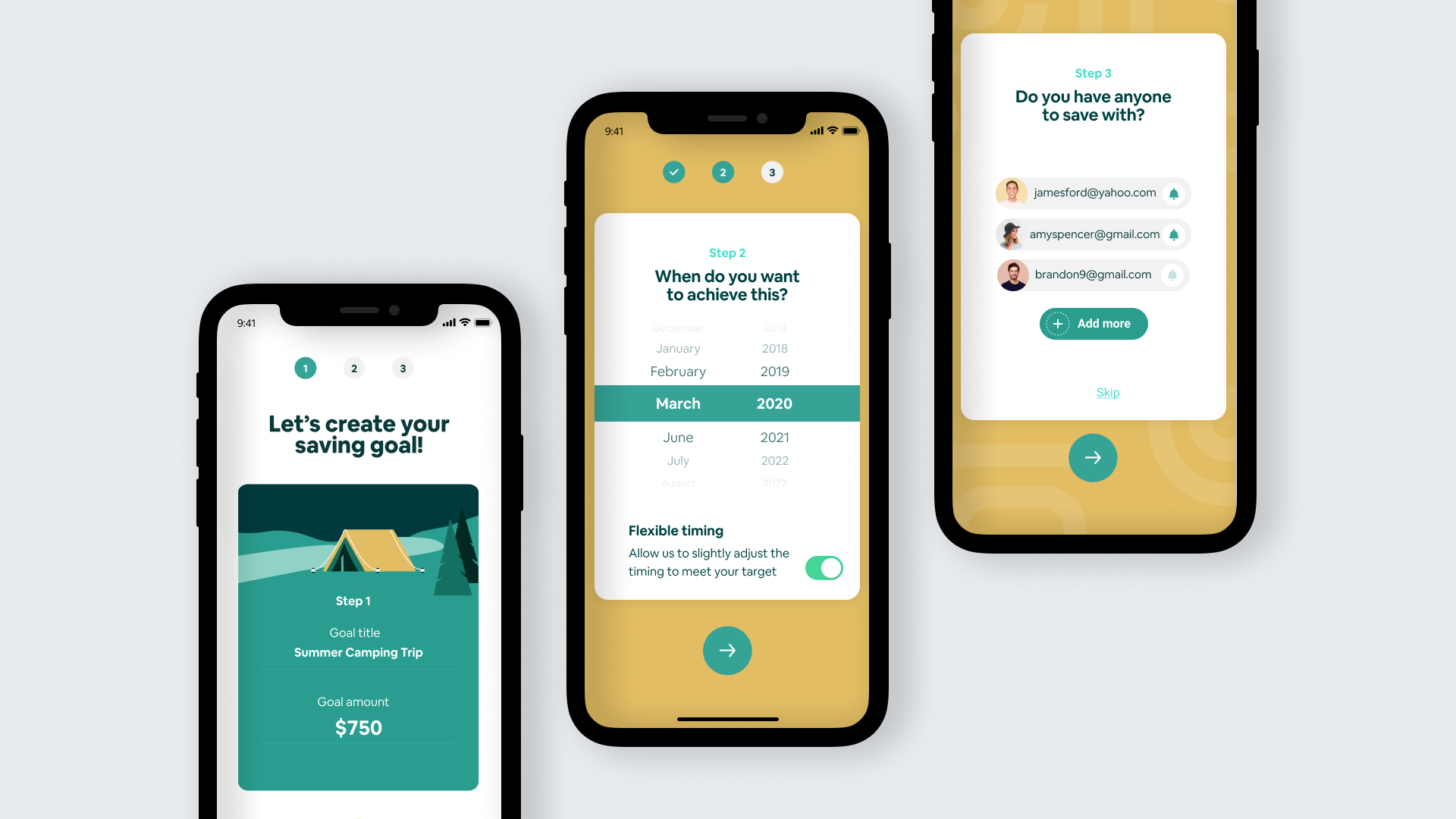

Nest is centered around promoting financial wellbeing. Financial wellbeing is defined by 4 main elements: having control over everyday finances, having the capacity to absorb financial shock, being on track to meet one’s financial goals; and having the freedom to make choices that allow you to enjoy life. In other words, financial wellbeing focuses on the past, present, and future of a person's financial situation. These aspects were brought into the application- the ability to view and track past spending, set up budgeting for different categories for the present, and set up goals and collaborate with friends on the same goals for the future.

The key aspects of the design were: simplicity of design to counteract the complexity of managing money and using finance tools; engaging a young target audience because it is beneficial to instil positive financial habits earlier on in life; and lastly, introducing savings goals in the application to orientate users towards the future, to motivate and encourage them.

This project utilised human-centered design process to address the issue of financial wellbeing among young people in New Zealand. During the project experts and prominent voices in the personal finance industry were interviewed to provide real-world constraints to the application and understand the issue of financial well-being. A user survey was carried out among the target audience to understand their needs and pain-points.

A person's financial wellbeing is influenced by their social and economic environment, financial knowledge and experience, attitude, and behaviour. It can be challenging and vulnerable to navigate a complex financial system from feeling guilty for not knowing how to manage money, to keeping track of spending, and not finding a tool that seems to solve the problem. Many prominent financial services benefit from people in vulnerable positions by monetising bad decisions or benefiting from a lack of transparency. There is a need for financial tools that puts people at the center, and in so doing, it humanizes the world of money and finance. The goal behind Nest, is to motivate and encourage people to improve their relationship with their money by creating good financial habits to achieve their financial goals and ultimately promote financial wellbeing.